The Ottawa Housing Market Is Not Slowing Down Anytime Soon

Tuesday, Dec 08, 2020

You have to ask yourself, when will the Ottawa real estate market ever slow down?

Based on the recent statistics in November, Ottawa is no longer slowing down anytime soon due to the following factors:

Decreased Inventory in Residential Listings

- The residential stock decreased by 50.2% with 1001 listings available compared to 2012 listings that existed in November 2019. This is attributed to residential properties being sold significantly over their listed prices in a shorter time period with a significant amount of buyers actively looking buying opportunities which are fuelling the demand.

Continued Record Sales In Residential Resale Market

- The residential resale market generated 1,209 houses sold, an increase of 26.5%, compared to 956 properties sold in the same month in 2019.

- Residential resale homes were sold quickly on average from 52 days to 24 days on the market, which is a 53.3% decrease from the same month in 2019.

- Based on the number of homes sold, buyers bought residential homes in the $450,000-$800,000 price range which accounted for 62.7% of the residential resale home sales.

- Based on the number of homes sold, buyers bought mostly:

- Two-storey homes - average sale price - $637,826 (previously $529,720 in November 2019)

- Bungalows (1-story) - average sale price - $559,773 (previously $443,586 in November 2019)

- Most of the residential homes were bought in:

- Downtown Ottawa - average sale price - $713,108 (previously $632,411 in November 2019)

- Kanata/Nepean/Barrhaven - average sale price - $624,980 (previously $509,027 in November 2019)

- Orleans - average sale price - $568,835 (previously $498,600 in November 2019)

Continued Record Condo Sales

- The condo market generated 402 units sold compared to 328 units sold in the same month in 2019, a 22.6% increase.

- Condo units continued to sell much quickly on average from 34 days to 26 days on the market, which is a 24% decrease from the same month in 2019.

- The record condo unit sales came at the time the condo market generated a 25% increase in available inventory which is a surprise. This is due to condo owners listing their units on the market to take advantage of the Ottawa's robust real estate market, and more buyers looking for opportunities in the semi-rural and rural areas which have large lot sizes and space that competitive price advantages than the urban core of the city.

- Based on the number of units sold, buyers bought most of the condo units priced in the $250,000 - $400,000 price range, accounting for 64.2% of the condo market.

- Based on the number of units sold, the most sold condo units were:

- Two-storey homes - average sale price - $337,139 (previously $279,463 in November 2019)

- One-level homes - average sale price - $379,977 (previously $342,251 in November 2019)

- Most of the condos bought were in:

- Downtown Ottawa - average sale price - $390,772 (previously $343,602 in November 2019)

- Kanata/Nepean/Barrhaven - average sale price - $336,784 (previously $271,093 in November 2019)

- Orleans - average sale price - $334,075 (previously $268,190 in November 2019)

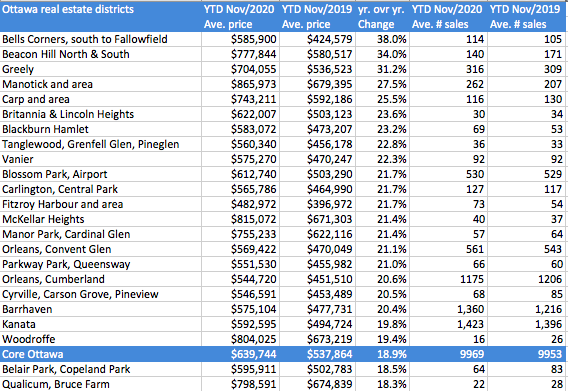

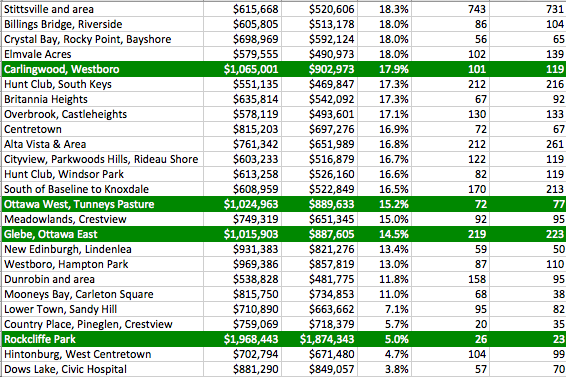

Semi-Rural and Rural Ottawa Gain Significant Increases in Year-To-Date Average Sale Prices

Districts in the semi-rural and rural areas were the top-ranked areas of the city that significant average sale price increases year-to-date (from November 2019 - November 2020):

- Bells Corners, Greely, Manotick and the surrounding areas and Carp were the districts that received the largest average sale price increases year over year above 25% (see results in the first table below)

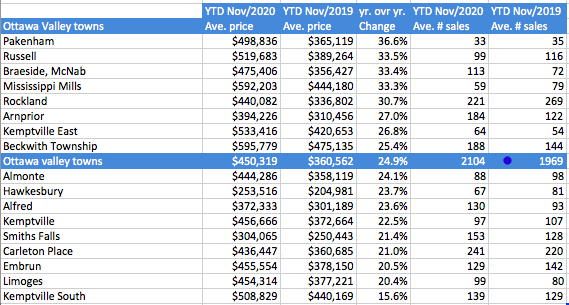

- In the Ottawa Valley, Pakenham, Braeside-McNab, Mississippi Mills, Russell, Rockland, Arnprior, Kemptville East and Beckwith Township recorded the largest price gains year to date. Average sale prices within these group of towns ranged from close to $400,000 in properties Arnprior to $596,000 for properties in Beckwith Township. (see results in the last table below)

Source: COVID as catalyst: How real estate in Ottawa changed in 2020, James Bagnall, Ottawa Citizen, December 5, 2020.