Ottawa's Average House Price Increases Are Declining

Average housing prices in Ottawa's residential resale market have been declining for a while despite modest price increases compared to August 2020 along with increasing buyer demand, low inventory, historically low mortgage rates, and the effects of the COVID-19 pandemic.

Here's why.

Residential Resale Prices Decreasing

- Average resale prices have decreased for five consecutive months in addition to August where the average resale price dipped below $675,000 for the first time since December 2020.

- In terms of average resale price increases, the average residential resale price increased modestly by 13.7% compared to August 2020.

New Housing Inventory Decreased

- New residential resale and condo listings decreased by 6.7% with 3,431 listings available in the market compared to 3,038 new listings that existed in August 2020.

Reduced Sales In Residential Resale Market

- 1,175 residential resale properties were sold, a decrease of 25.1%, compared to 1,568 properties sold in August 2020.

- Residential resale properties were not sold quickly on average from 24 days to 22 days on the market, which is a 4.9% decrease from August 2020.

- Based on the number of properties sold, buyers purchased residential properties in the $500,000 - $900,000 price range and over $1,000,000 price range which accounted for 74.6% of the residential resale property sales.

- Despite lower residential sale numbers compared to August 2020, buyers purchased mostly:

- Two-storey properties - average sale price - $706,127 (previously $627,681 in August 2020)

- Bungalows (1-storey) - average sale price - $635,886 (previously $561,042 in August 2020)

- Most of the residential properties were purchased in:

- Downtown/Central Ottawa - average sale price - $823,391 (previously $749,110 in August 2020)

- Kanata/Nepean/Barrhaven - average sale price - $684,634 (previously $611,282 in August 2020)

- Orleans - average sale price - $672,156 (previously $591,730 in August 2020)

- Casselman/Rockland/Hawkesbury - average sale price - $534,202 (previously $435,240 in August 2020)

Reduced Sales In Condo Resale Market

- 397 units were sold compared to 438 units sold in the same month in 2020, a 9.4% decrease.

- Condo units did not sell quickly compared to residential properties. They were sold on average from 19 days to 28 days on the market, which is a 45.3% increase from the same month in 2020.

- Based on the number of units sold, most buyers purchased condo units priced in the $300,000 - $450,000 price range, accounting for 64.5% of the condo market.

- Despite lower condo sales compared to August 2020, the most sold condo units were:

- Two-storey units - average sale price - $393,979 (previously $363,849 in August 2020)

- One-level units - average sale price - $409,213 (previously $398,856 in August 2020)

- Most of the condos purchased were in:

- Downtown/Central Ottawa - average sale price - $451,685 (previously $384,047 in August 2020)

Other Real Estate Trends

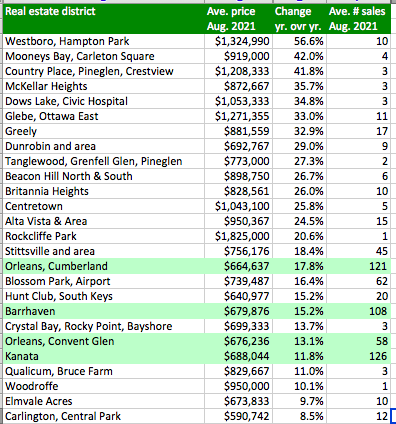

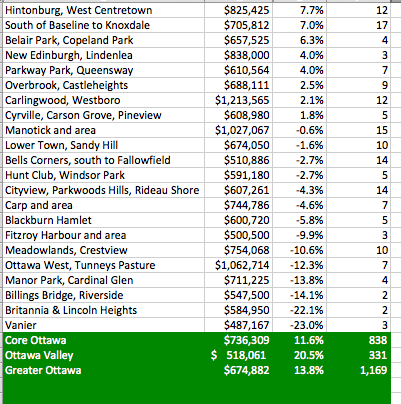

- Within Ottawa's city limits, half of the sales in the resale market occurred in Orleans-Cumberland, Orleans-Convent Glen, Barrhaven and Kanata. (See results in the first table below in the far left).

- Specific district neighbourhoods in Ottawa received excessive property market values based on significant sale price gains of over 30%: Westboro- Hampton Park; Kemptville South; Mooney's Bay, Carleton Square; Country Place, Pineglen, Crestview; McKellar Heights; Dows Lake-Civic Hospital; Glebe-Ottawa Eas, Greely and Smiths Falls. (See results in the first table below in the far left).

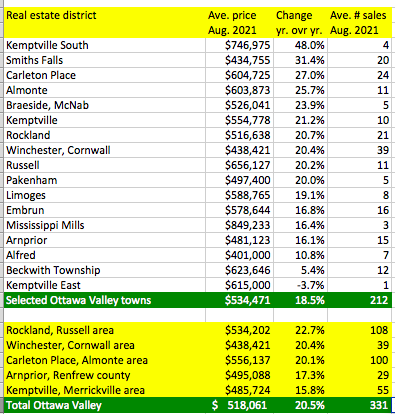

- There is a continuous demand and popularly among buying residential properties in the rural parts of Ottawa, particularly in Smiths Falls, Carleton Place, Rockland, Winchester and Cornwall. As a result, average sale prices in those areas increased by nearly 21% compared to the same month in 2020.(See results in the third table below in the far right).

Source: James Bagnall, Ottawa Citizen, @JamesBagnall1, September 3, 2021