Ottawa Real Estate Market Still Strong In March Despite Increasing Interest Rates

Despite low sales compared to previous years, along with high interest rates, Ottawa's resale real estate market continued to go strong.

This is what happened in the market in March.

Record Average Sale Price Increases

- Average sale price of a residential resale property was $853,000, a 12.5% increase compared to March 2021.

- For condos, the average sale price was $479,000, a 9.6% increase compared to March 2021.

- Despite these record average sale prices, they generated the lowest average sale price increases since the start of the COVID-19 pandemic in March 2020.

Slight Increase In Total Property Listings

- Combined residential resale and condo listings increased slighlty by 4.4%% with 960 residential resale listings and 286 condo listings available in the market compared to 1,194 combined listings in both property markets that existed in March 2021.

Decreased Sales In Residential Resale Market

- 1,493 residential resale properties were sold compared to March 2021 where 1,697 properties were sold, a 12% decrease.

- Residential resale properties were sold on average from 12 days to 14 days on the market, which is about 16.1% increase from March 2021.

- Most residential resale properties were sold above $700,000 to $900,000 and over $1,000,000 price range which accounted for about 61% of residential resale property sales.

- Buyers purchased mostly:

- Two-storey properties - average sale price - $889,721 (previously $787,397 in March 2021).

- Three-storey properties - average sale price - $852,871 (previously $816,328 in March 2021).

- Bungalows (1-storey) - average sale price - $814,499 (previously $714,965 in March 2021).

- Most of the residential properties were purchased in:

- Kanata/Nepean - average sale price - $886,655 (previously $796,657 in March 2021)

- Downtown/Central Ottawa - average sale price - $965,084 (previously $882,758 in March 2021)

- Orleans - average sale price - $782,445 (previously $695,131 in March 2021)

- Casselman/Hawkesbury/Rockland - average sale price - $668,885 (previously $573,187 in March 2021)

Continued Reduced Sales In Condo Resale Market

- Similar to the residiential resale market, 518 units were sold compared to 577 units sold in the same month in 2021, a 10.2% decrease.

- Similar to the residential resale market, condos sold quickly on average from 18 days to 14 days on the market, which is about a 18% decrease from the same month in 2021. Based on the average number of days, residential resale properties were sold more quickly by 12 days less than those sold in February 2022 which were from 31 days to 26 days.

- Most condo units were sold in the $300,000 - $550,000 price range, accounting for about 76% of the condo sales.

- Despite lower condo sales compared to March 2021, the most sold condos were:

- 2-storey properties - average sale price - $500,235 (previously $446,222 in March 2021)

- One-level units - average sale price - $458,735 (previously $433,796 in March 2021)

- Most of the condos purchased were in:

- Downtown/Central Ottawa - average sale price - $481,085 (previously $452,116 in March 2021).

Other Real Estate Trends

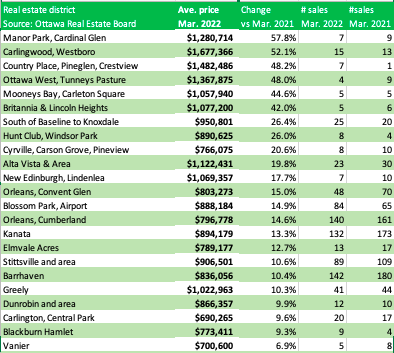

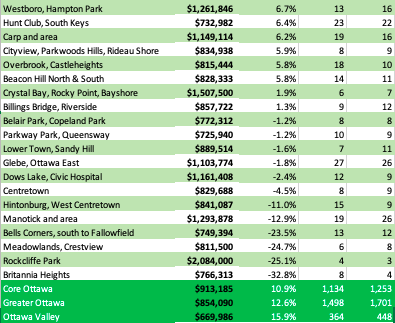

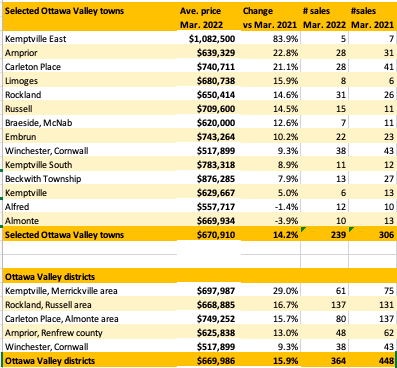

- 16 districts in Ottawa sold residential resale properties that were priced on average for $1 million and over. (see table graphics below for details).

- 12 districts in Ottawa and the Ottawa Valley that had significant average sale prices of at least 20% and above from March 2021 to March 2022 (see table graphics below for details)

- Average sale price increases in Greater Ottawa and Ottawa Valley (28.5%) were greater than the average sale price increase in Ottawa's city core (10.9%). This trend indicates that buyers are interested in buying affordable properties where they cannot find properties they can afford within Ottawa's city core.

Source: James Bagnall, Ottawa Citizen, Ottawa's housing market keeps rolling despite higher interest rates, April 6, 2022